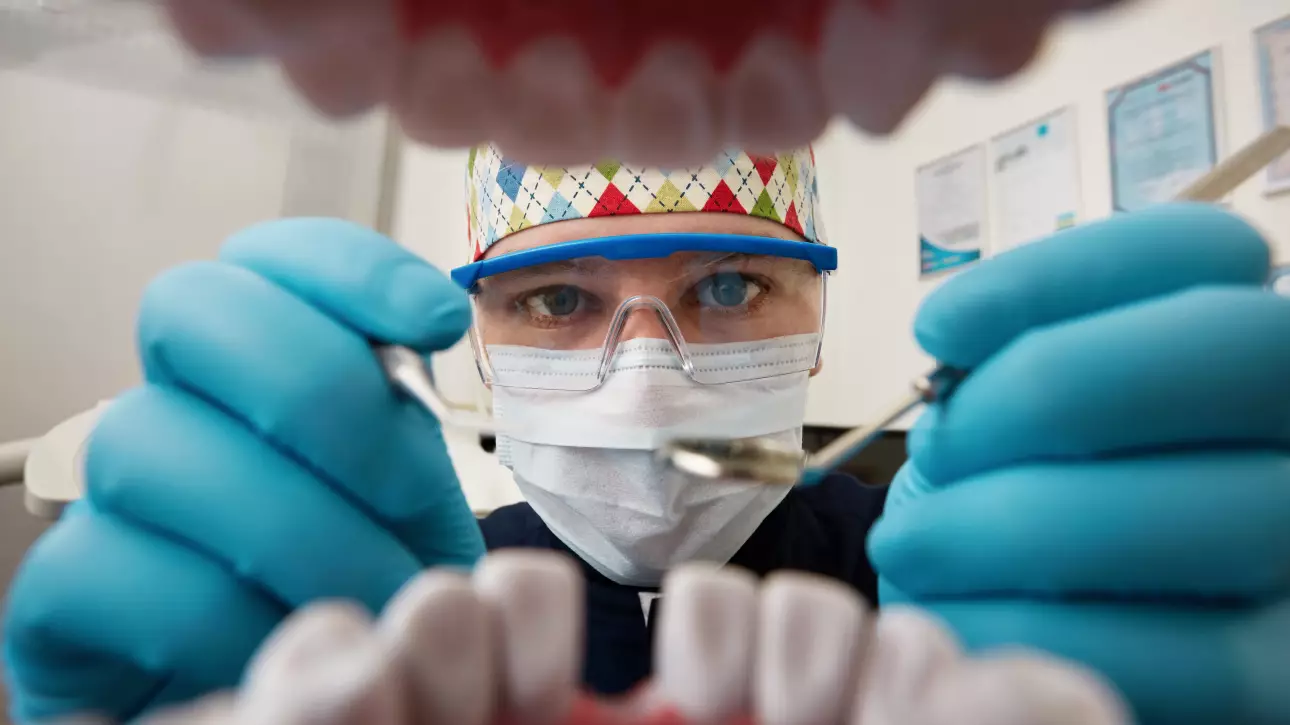

Dental implants are among the highest-value procedures in modern dentistry. Yet many practices fail to collect the full reimbursement available simply because implant cases are not coded strategically. If your team is billing implants under a single insurance pathway without reviewing all applicable benefits, you may be leaving thousands of dollars uncollected every month. In…